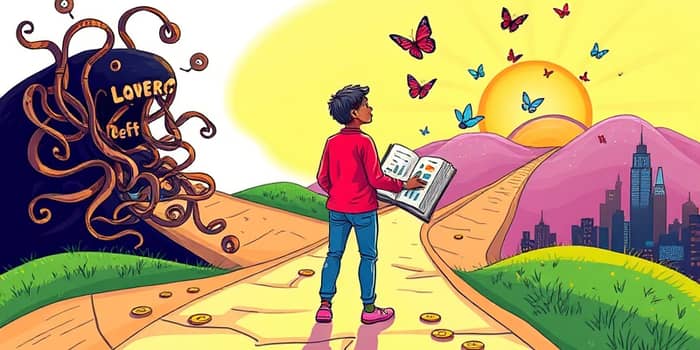

Your financial life is not just a series of transactions; it's a story waiting to be written. Imagine turning every challenge into a plot twist that leads to growth and triumph.

By embracing the concept of financial storytelling, you can shift from feeling overwhelmed to feeling empowered. This narrative approach helps you see money as a tool for crafting your ideal future.

In this journey, real people have transformed debt into freedom and scarcity into abundance. Their experiences show that rewriting your money story is possible for anyone willing to take the first step.

The Power of Financial Storytelling

Financial storytelling frames your money journey as a personal epic. Instead of focusing on numbers alone, it emphasizes emotions, goals, and resilience.

This mindset encourages you to view setbacks as temporary chapters. It builds confidence and motivates action towards long-term success.

Stories like those of Krys or Liz and Jeff illustrate how shifting perspective can lead to dramatic outcomes. Their journeys from debt to freedom are testaments to this powerful approach.

Shifting Your Mindset: From Scarcity to Abundance

A scarcity mindset sees money as limited and stressful. An abundance mindset views it as a resource to be managed and grown.

This shift starts with small, intentional changes. Celebrate small wins to reinforce positive thinking and build momentum.

Key strategies to cultivate an abundance mindset include:

- Practicing gratitude for what you have

- Setting clear financial goals as milestones

- Visualizing your success story regularly

- Surrounding yourself with supportive communities

By adopting these habits, you can transform fear into opportunity and open doors to new possibilities.

Budgeting as Narrative Control

Budgeting is not about restriction; it's about taking control of your story. Tools like YNAB help you allocate funds intentionally, turning chaos into order.

Living on last month's income, as many success stories show, creates a buffer against emergencies. This practice reduces stress and increases financial stability.

Effective budgeting tools and methods include:

- Using envelope systems for cash management

- Tracking expenses with apps or spreadsheets

- Scheduling regular money meetings with partners

- Setting up automatic savings for goals

These approaches empower you to direct your financial plot with confidence and clarity.

Debt Payoff: Turning Liabilities into Assets

Debt can feel like a villain in your story, but it can be defeated with strategy. Prioritizing high-interest debt and using frugal habits accelerates payoff.

Real-life examples demonstrate that debt freedom is achievable. Below is a table highlighting key success stories from various backgrounds.

These stories prove that consistent effort pays off, turning debt into a stepping stone for wealth.

Building Wealth: Saving, Investing, and Side Hustles

Wealth building is the climax of your financial narrative. It involves saving diligently, investing wisely, and boosting income through side hustles.

Emergency funds act as a safety net, allowing you to handle surprises without derailing your story. Aim for three to six months of expenses.

Key principles for wealth accumulation include:

- Starting with an emergency fund as a foundation

- Investing in low-cost index funds for growth

- Exploring real estate or entrepreneurship for passive income

- Maximizing retirement account contributions

Side hustles, like consulting or gig work, can accelerate your financial goals and add exciting subplots to your journey.

Overcoming Adversity: Stories of Resilience

Adversity, such as divorce or job loss, can feel like a dark chapter. Yet, many have turned these challenges into opportunities for growth.

For example, a post-divorce woman adapted to monthly pay and achieved stability within a year. Her story highlights the power of resilience.

Strategies to overcome financial setbacks include:

- Reinventing yourself through new skills or careers

- Seeking sound financial guidance from mentors

- Maintaining a positive outlook during tough times

- Using adversity as motivation to rebuild stronger

These approaches show that resilience rewrites endings, leading to brighter futures.

A Narrative Toolkit: Practical Steps to Rewrite Your Story

To master your financial narrative, arm yourself with actionable steps. This toolkit combines mindset shifts, budgeting techniques, and wealth-building strategies.

Start by assessing your current story. Identify pain points and celebrate small victories to build momentum.

Essential steps include:

- Tracking all expenses for one month to gain clarity

- Creating a budget that aligns with your goals

- Paying off high-interest debt aggressively

- Building an emergency fund before investing

- Exploring side income opportunities

- Educating yourself on financial literacy basics

By implementing these steps, you can craft a compelling success story that inspires others.

Long-Term Outcomes: Your Success Chapter

The final chapter of your financial narrative involves achieving long-term goals like early retirement, homeownership, or legacy building.

Stories like Mark and Lisa's real estate success or David's entrepreneurial journey show that patience and discipline yield rich rewards.

Focus on sustainable habits that maintain joy without deprivation. Generosity and family priorities should remain central to your story.

Visualize your success and take consistent action. Your financial narrative can lead to a life of freedom, purpose, and fulfillment.

Remember, every step forward is a new paragraph in your story. Embrace the journey with courage and optimism.

References

- https://www.ynab.com/blog/9-inspiring-financial-stories

- https://www.tombiblelaw.com/blog/2024/july/achieving-financial-freedom-real-stories-from-th/

- https://www.youtube.com/watch?v=RYSMcZH12Vw

- https://www.qnbtrust.bank/Resources/Learning-Center/Blog/financial-literacy-is-vital-henrys-success-story

- https://www.uwstory.org/success-stories

- https://www.dowjanes.com/success-stories

- https://www.businessinsider.com/personal-finance/money-stories

- https://moneymentors.ca/resources/stories/

- https://www.atypicalfinance.com/success-stories/