In an era defined by both global policy shifts and individual quests for stability, the concept of an "autonomy dividend" bridges macro and micro perspectives.

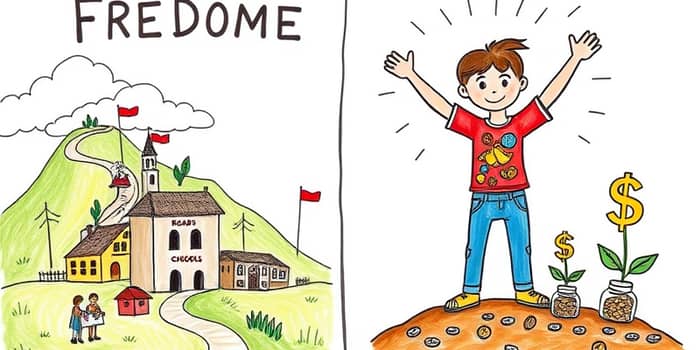

At its heart, it combines the idea of a peaceful allocation of resources on a societal scale with the pursuit of personal financial sovereignty. Whether enacted through government policy or individual money management strategies, the autonomy dividend rewards foresight, discipline, and reinvestment.

Understanding the Autonomy Dividend

Originally coined in governance contexts, a peace dividend refers to reducing defense spending and redirecting those funds to development and welfare. In Aceh, Indonesia, a special autonomy fund channels oil and gas revenue back into local communities, fueling infrastructure, empowerment programs, and poverty eradication.

On the personal side, financial autonomy means securing the freedom to live in alignment with one’s values. It entails structuring your finances so that work becomes optional, not compulsory, and every dollar plays a deliberate role.

The unifying thread is clear: strategic reinvestment of gains creates sustained progress. Governments reinvest peace dividends to nurture social stability; individuals reinvest savings and returns to build resilience and opportunity.

Building Personal Financial Autonomy

Transforming earnings into autonomy requires a systematic approach. The following core principles form the foundation of a robust personal finance strategy:

- Give every dollar a purpose: Assign money to categories like bills, fun, long-term goals, and investments. Use budgeting apps or separate accounts to maintain clarity.

- Automate savings and investing: Set up automatic transfers to savings accounts and retirement vehicles immediately after each paycheck, effectively paying yourself first.

- Track and adjust spending: Regularly compare ideal and actual allocations, focusing first on trimming fixed costs like housing, transport, and insurance.

- Eliminate high-interest debt: Attack credit cards and loans with the highest rates to free up cash flow and reduce overall interest burden.

By embedding these principles into daily routines, you build momentum and cultivate habits that fuel long-term progress.

Celebrating small wins—like paying off a loan or hitting a monthly saving target—reinforces commitment and paves the way toward compound interest over the long term.

Strategic Investment Structures

An effective investment strategy balances risk and reward while considering tax efficiency. Key components include diversification across asset classes, geographies, and sectors, combined with cost minimization and disciplined scheduling.

Adopt a long-term perspective: focus on decades of growth rather than short-term market swings. Use low-fee index funds and ETFs, implement dollar-cost averaging, and maintain a diversified portfolio of stocks, bonds, real estate, and alternative assets.

To maximize after-tax returns, consider strategies such as tax-loss harvesting in taxable accounts and positioning tax-inefficient assets within retirement vehicles. This approach ensures you capture every available advantage and preserve more wealth for future reinvestment.

This example from Aceh illustrates how resource reallocation can transform communities. On a personal scale, your portfolio table might replace policy components with asset types and objectives, but the underlying principle remains the same: allocate strategically, reinvest consistently.

Behavioral and Psychological Foundations

Financial success is as much mental as it is mathematical. Consistency breeds lasting financial independence, and automation removes the friction of decision-making. By automating contributions to savings and investment accounts, you eliminate the temptation to prioritize immediate gratification.

Embracing a mindset of resilience—preparing for unexpected challenges with a solid emergency fund of 3–6 months of expenses—cultivates confidence. This readiness underpins operational freedom to make choices during market downturns or personal crises.

Movements like "revenge saving" demonstrate how millennials and Gen Z are redefining autonomy. Their focus on intentional saving and debt reduction highlights a shift toward conscious control over financial destinies.

Goal Setting and Accountability

Clear, measurable objectives transform vague aspirations into actionable missions. Effective goal setting involves:

- Defining targets: e.g., save $10,000 for a home down payment or build a 6-month emergency fund.

- Tracking progress: use spreadsheets, apps, or journals to monitor balances and spending patterns.

- Reviewing regularly: adjust budgets and strategies in response to life changes or market conditions.

By holding yourself accountable—celebrating milestones and reassessing challenges—you create a feedback loop that accelerates growth and reinforces good habits.

From Policy Lessons to Personal Practice

The autonomy dividend at a national scale and the pursuit of personal financial freedom share a blueprint: strategic allocation of resources, disciplined discipline, and continual reinvestment of returns.

Governments channel peace dividends into infrastructure, education, and empowerment to address root causes of instability. Individuals channel earnings into diversified investments, emergency reserves, and debt reduction to secure stability and future choice.

Ultimately, the greatest dividend is freedom: the freedom to choose work for purpose rather than necessity, to support causes aligned with values, and to shape a life unshackled by financial constraints.

By adopting the principles of the autonomy dividend—whether on a grand scale or a personal ledger—you invest not just money, but hope, opportunity, and resilience. Start today, and watch your autonomy compound into a legacy of choice and impact.

References

- https://d-nb.info/1243183977/34

- https://www.kiplinger.com/personal-finance/guide-to-true-financial-freedom-from-a-financial-planner

- https://www.tradefinance.training/blog/articles/the-principle-of-autonomy/

- https://www.earnin.com/blog/financial-freedom

- https://www.iwillteachyoutoberich.com/financial-freedom/

- https://lifestyle.sustainability-directory.com/term/financial-autonomy/

- https://ntltrust.com/news/lifestyle/the-key-steps-to-your-personal-economic-freedom/

- https://www.anthropic.com/engineering/effective-context-engineering-for-ai-agents

- https://www.ublocal.com/revenge-saving-how-millennials-and-gen-z-are-taking-control/

- https://www.sccu.com/articles/personal-finance/guide-to-achieving-financial-freedom

- https://www.raisin.com/en-us/retirement/financial-freedom/

- https://investor.vanguard.com/investor-resources-education/article/persist-when-others-quit